Understanding the intricacies of tax filing can be overwhelming, but the IRS Form W-2 serves as a crucial tool in that process. Issued by employers, this form details the total wages paid to an employee and the taxes withheld during the calendar year. It is essential for preparing individual income tax returns and serves as a significant document in the overall tax-filing journey. As a taxpayer, having accurate knowledge about the W-2 form ensures a seamless submission process, ultimately minimizing headaches and potential issues with the IRS.

That's where the value of w2-form.us comes into play. Our dedicated website offers a downloadable W2 form for 2023, along with comprehensive material that simplifies the entire process. The provided instructions and real-life examples make the task of filling out the IRS W2 form in 2023 a breeze. On top of that, you can readily print blank W2 form directly from our platform, ensuring that you stay ahead of the taxation curve. By leveraging these resources, users gain the confidence to complete their tax filing accurately and quickly, with the comfort of knowing they are prepared for a smooth experience in their financial journey.

The IRS Form W2 Importance in U.S. Taxation

Are you wondering whether you need to fill out a federal W2 form for 2023? This important tax document must be completed by employers who have employees earning more than $600 in a calendar year. In order to get W2 form details right, you must know about a few exemptions.

Here's a quick rundown of instances when you don't have to print the W2 form for 2023:

- Independent contractors

Self-employed workers who receive 1099 forms aren't required to fill out W2s. - Some agricultural workers

Farm laborers whose income falls below a certain threshold may be exempt. - Household staff

Domestic employees, such as nannies or housekeepers, whose wages don't cross particular limits.

Remember, always consult a tax professional to ensure compliance with the latest requirements and regulations.

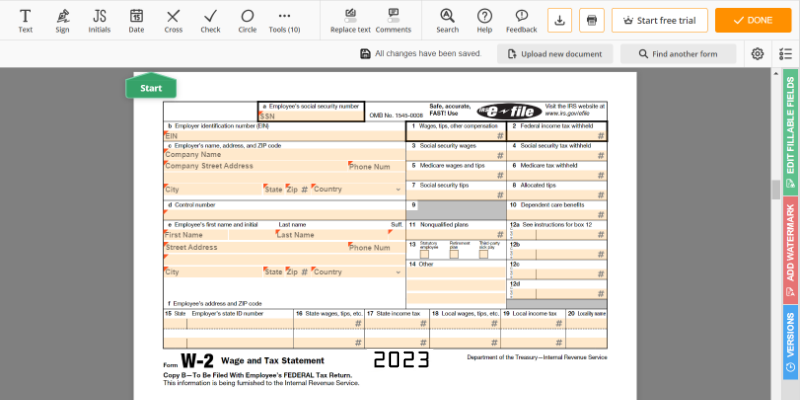

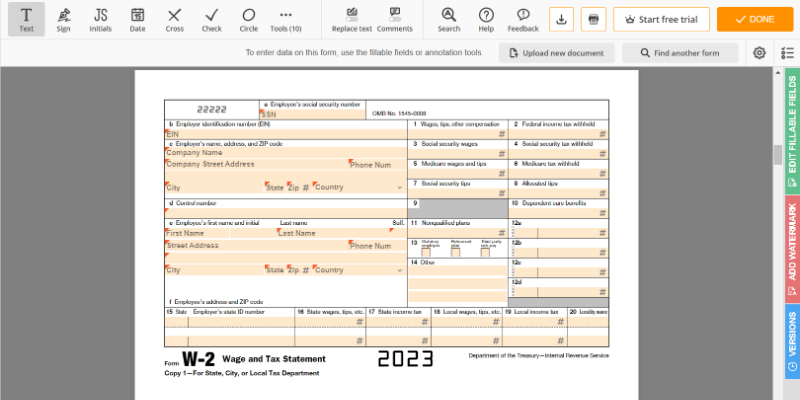

Blank W-2 Template: Instructions to Complete the Form

Start your journey to a stress-free tax season with our user-friendly website that provides a step-by-step guide to filling out your W-2 form error-free.

- Begin by locating the printable W2 form for 2023 (on the page you visit now) to access the newest document for this year.

- Carefully read the instructions provided, ensuring you fully understand each section before proceeding.

- Collect relevant information from pay stubs, such as your employer's name, address, and EIN (Employer Identification Number).

- To avoid errors, input the required details in the corresponding fields as you print IRS Form W2.

- Double-check the figures you entered to ensure accuracy, paying close attention to the wages, social security, and Medicare withholdings.

- When finished, print the completed W-2 form for employee tax filing.

- Provide copies for your employer, state, and local authorities, and keep one for your records.

Schedules to Fill Out & File W2 Form

The due date for submitting your W-2 form might seem oddly specific, but there's a reason for it. Employers are required to provide a W-2 form sample to their employees by January 31st, ensuring ample time for employees to review and prepare their personal tax returns. Consequently, the due date to file W-2 copies with the Social Security Administration is set for the same day, safeguarding a seamless transition for both parties.

As a savvy entrepreneur, you might wonder if there's any deadline flexibility. Unfortunately, there isn't an automatic extension for filing the W-2 form. However, if you encounter unavoidable circumstances that prevent timely submission, you can submit Form 8809 to request a 30-day extension. Remember that this must be done before the original deadline; otherwise, penalties may apply. Strategize and manage your tax requirements efficiently to avoid any last-minute hassles.

Printable W2 Form for 2022-2023

Printable W2 Form for 2022-2023

Blank W2 Form PDF

Blank W2 Form PDF

Free Fillable W-2 Form

Free Fillable W-2 Form

W2 Tax Form Online

W2 Tax Form Online

Printable IRS W-2 Form

Printable IRS W-2 Form